Realizing payment success through high authorization rates, minimal fraud incidents, and reduced processing costs is complex. And we understand that optimizing this aspect of your business may seem overwhelming due to a perceived lack of resources, time, and insight.

However, neglecting payment optimization will hinder your business potential. When executed correctly, payments can boost your bottom line, enhance customer satisfaction, differentiate you from competitors, and more. And there are new, powerful solutions available that cut through payments complexity and allow you to deliver payments success faster and more readily than ever.

Here we'll review nine tried-and-tested best practices any business can adopt to leverage payments for growth.

Why might you have low online payment success?

Before exploring how to deliver payments success, let's look at the issues your business might face today.

- Checkout complexity: payment success will be lower if an overcomplicated checkout process deter customers from completing purchases.

- Extended transaction completion: customers may forgo purchases if the transaction takes too long to complete. This could be from slow page load times, intricate checkouts, or distractions.

- Geographical variations: different locations will have specific payment preferences, regulations, or internet connectivity challenges. Ignoring these differences will impact payment success.

- Limited payment methods: businesses lacking diverse payment options could be turning away customers, resulting in low conversion rates and decreased payment success.

- Absence of smart routing: PSPs have different payment success rates depending on various data points, including payment type, currency, geography, etc. Without smart routing, businesses risk a higher chance of payment failure by not routing payments through the optimal PSP.

- Data security concerns: customers may abandon transactions at the checkout if they have concerns regarding potential security risks and their card data.

- Technical integration: failure to integrate the payment gateway with the website or application can lead to transaction failures and low payment success rates.

- Multiple currencies: there may be an increase in failed transactions if international businesses don't support multiple currencies.

Nine ways to boost payment success

Payment success can be achieved in multiple ways depending on the needs of your business. Each method will sit under one of three categories: conversion, acceptance, or fraud. Let's explore them to see which options could work for you.

Conversion

The average checkout abandonment rate touches a frightening 69%. Making small changes to optimize for conversion can greatly impact top-line sales and increase payment success.

#1. Offer more payment options

It may seem obvious, but if your customers can't pay you at checkout, they won't complete their purchase.

Today, traditional card payments only make up 35% of online transactions worldwide. If you choose to accept cards exclusively, you're seriously missing out: 56% of shoppers want a variety of payment methods at checkout.

With multiple payment options now available in each market, people often adopt various payment methods as they see fit. 15% of consumers use at least three payment methods.

To thrive, your business has to adapt to consumer behaviors. However, keeping up with new payment innovations and integrating and maintaining payment methods is tricky and costly. Historically this required multiple contracts and integrations that needed managing with different PSPs and payment providers.

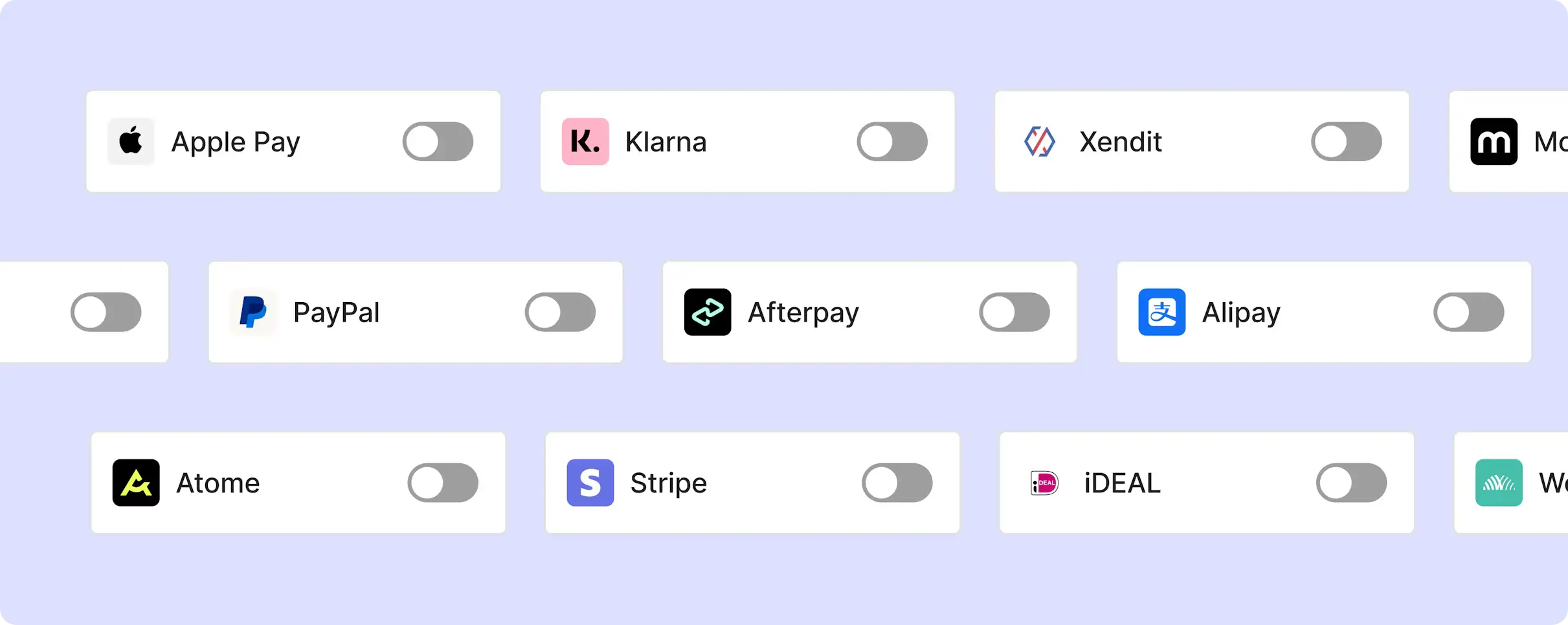

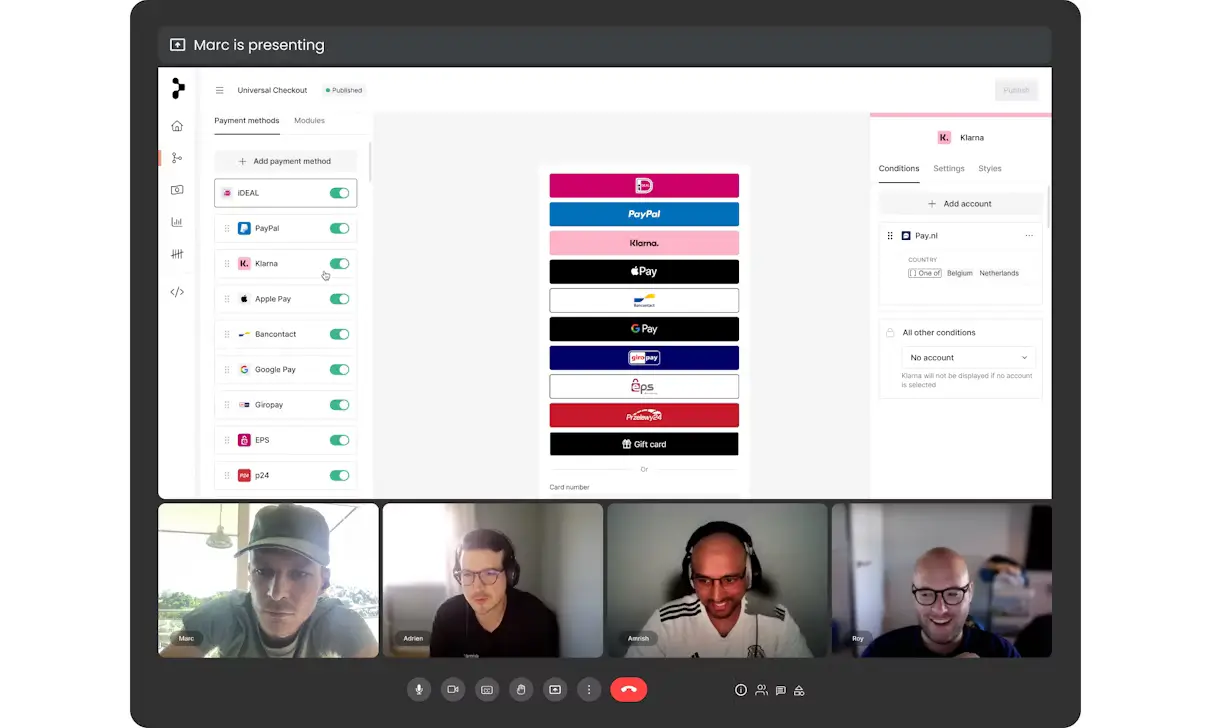

But with a service like Primer which supports over 50 payment integrations—which you can view in our Connections hub—meeting your customer expectations is easier than ever. You can add any third-party integration to your checkout in a click, right from Primer's dashboard—with no code. The best bit? We're always adding more Connections so your payment stack can effortlessly scale over time.

#2. Adapt to any market

Now we've agreed choice is key; remember that it can be a double-edged sword. While you'd like to enable customers to pay however they want, an abundance of (irrelevant) options results in an overly complicated checkout, which accounts for 17% of abandoned shopping carts.

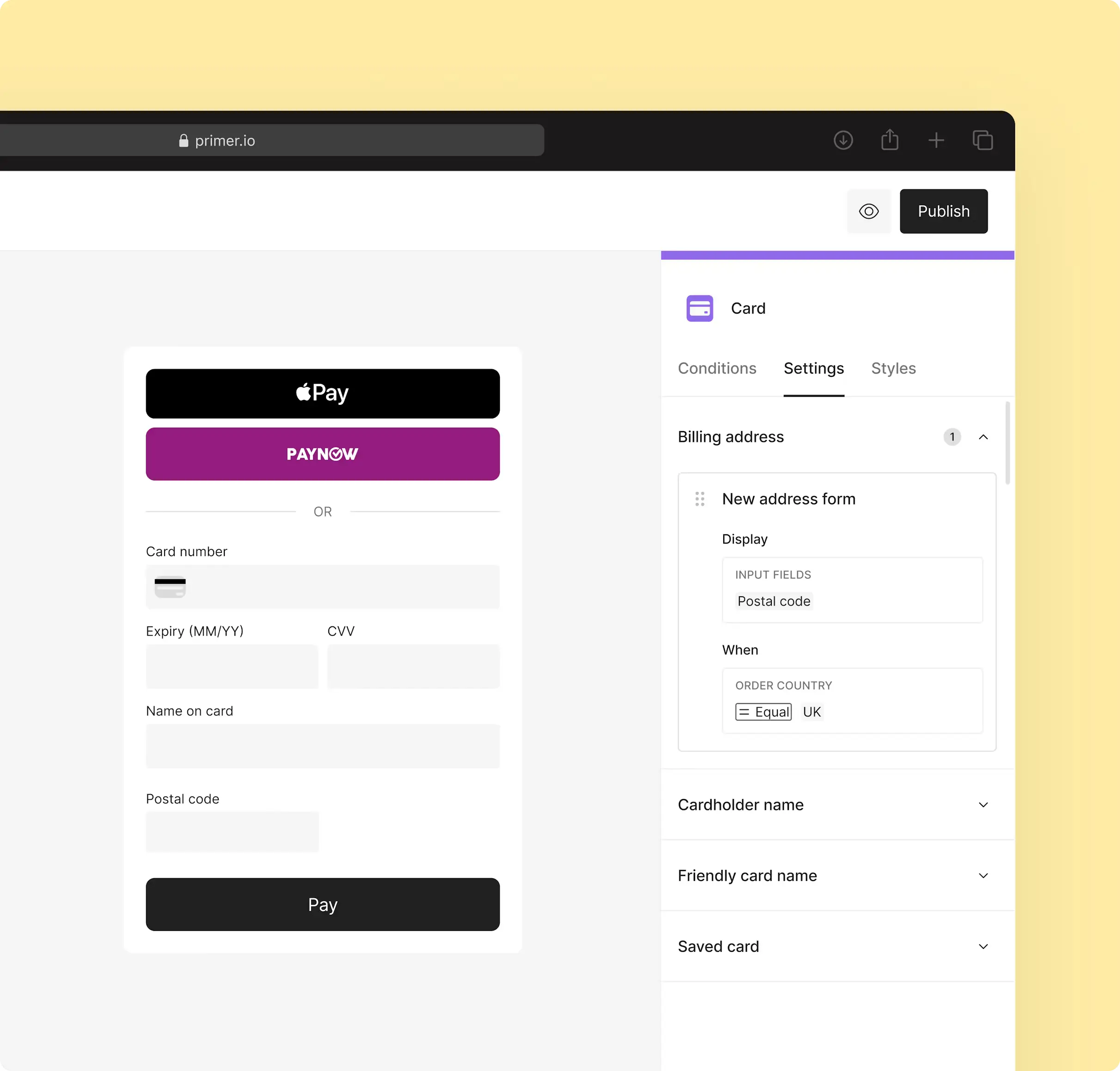

Primer developed Universal Checkout, a low-code product that lets you easily build your checkout in context with a few simple clicks. In the dashboard, you can add limitless payment methods, then choose where and when they're placed to suit customers worldwide. By dynamically presenting the best options for each market, you'll cater to specific regional preferences, speed up the checkout process and increase payment success.

See how Zenyum tripled its market reach in one year with Primer.

For example, PayNow is a popular peer-to-peer, real-time fund transfer system in Singapore. By setting PayNow to only display at checkout for customers in Singapore, you're offering the payment option they need while streamlining the checkout for shoppers everywhere else.

#3. Collect less data

While we're on the topic of making things simple: do you need all that data you're collecting from your customers? We've all been there: there's nothing worse than filling out endless form fields when trying to make a purchase. Still, research shows US retailers require customers to complete twice as many fields as necessary.

At Primer, we understand this data may sometimes be required to help prevent fraud or to challenge disputes. We've allowed merchants to easily set billing conditions for card payments and only capture data within Universal Checkout when necessary.

In Primer's dashboard, for example, you can set up a rule so only the billing address postal code is requested for card payments, and specify even more by activating this rule for high-risk items or customers only.

#4. Stop forcing friction

Strong Customer Authentication regulations in the European Economic Area (EEA) and the UK add another obligatory step to the checkout process for customers in these jurisdictions. And while authenticating customers using 3DS offers a great layer of protection from payment fraud, it adds more friction, harming your conversion and overall payment success rate.

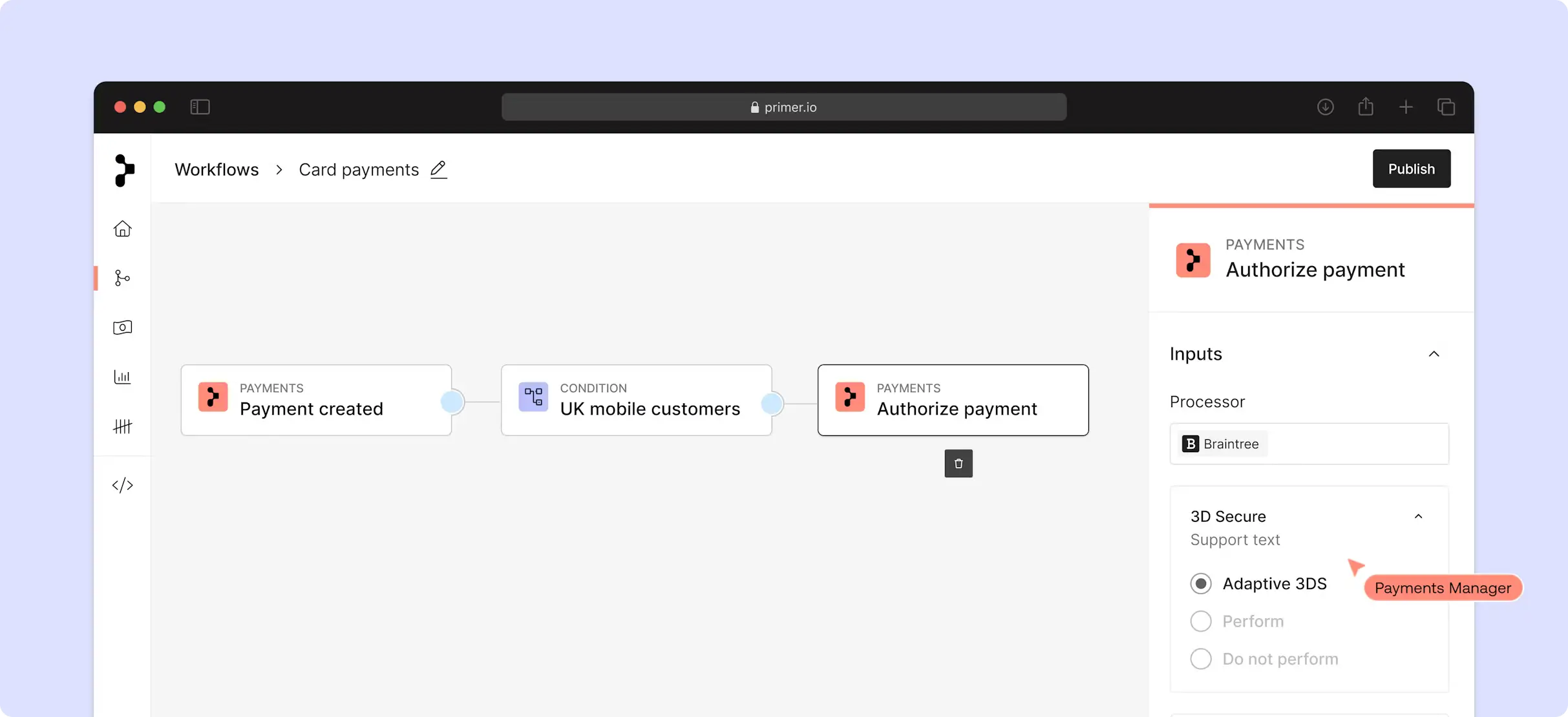

Businesses must strike a balance and apply 3DS where required, and based on their unique risk appetite. To empower businesses to do this, Primer has built Adaptive 3DS. Rather than defaulting to force 3DS for all customers or not adding it, we'll dynamically choose when 3DS should be triggered.

Our AI-based 3DS product evaluates customers' buying history, location, and even which device they're using. So we know exactly when to issue a customer challenge and when to allow a frictionless checkout experience. All this without typing a single line of code.

Acceptance

Now you're confident the number of customers that make it through checkout has improved, it's time to tackle the next challenge. One of the questions we get the most is: "How do I create the best possible chance for payment success?"

#5. Build in a backup

Your biggest sales period of the year has arrived. You've spent months planning for it: ordering inventory, crafting tailored marketing campaigns, and increasing advertising spend. Everything's led to this crucial moment, and suddenly your payment processor goes down.

Due to circumstances completely out of your control, you cannot accept payment from customers, and your Support Team is getting countless angry calls.

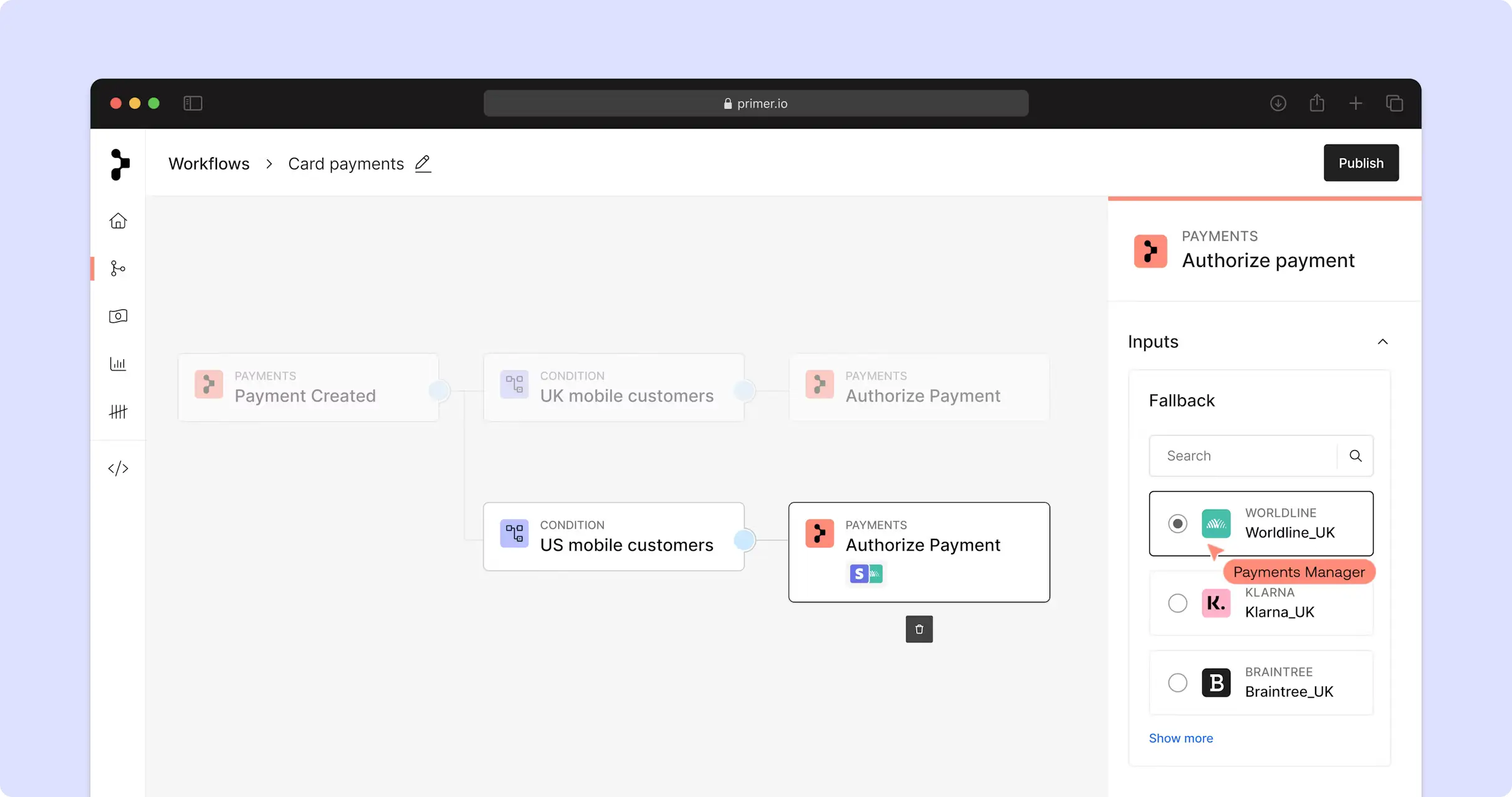

If this sounds familiar or you'd like to avoid this scenario at all costs, you need a backup plan. In payments, this is known as fallbacks—a secondary payment provider put into action when your primary processor's redundant.

Primer has automated the fallback process to keep things running smoothly on the front end. When you set up a new payment route with Workflows, you can choose a fallback processor, so in the event of a failed or declined payment, your backup is seamlessly put into play. Your customers won't notice a thing, and you'll continue to accept payments as usual.

#6. Get expert payment support

Payments are tricky and ever-changing. Most businesses implement payment logic based on conditions set by their Payments Manager, leaving things open to interpretation and mistakes being made.

The problem with payments is these mistakes aren't obvious because they often don't result in immediate failures that are easy to spot. You'll only gradually notice them over a long period, resulting in far more loss of revenue.

A great example of this is subscription payments. If something's wrong with the initial subscription setup, like the customer's location or payment method, you won't detect this until the next billing cycle, at the earliest.

You shouldn't be a payment expert for payments to work. With Primer, these mistakes are eliminated by putting the payment logic firmly in the hands of experts. We specialize in payments and are here to help you unlock payment success for your business.

#7. Pay attention to the smallest details

Ever heard of marginal gains? Originally coined for Olympic performance cycling, this theory applies when optimizing authorization rates. It's all about small, incremental fixes in a process, which, when added together—amount to significant improvement.

You'll unlikely find a silver bullet to boost your auth rates in one fell swoop. Instead, it would be best to focus on optimizing every detail. When combined, these can result in monumental monetary gains.

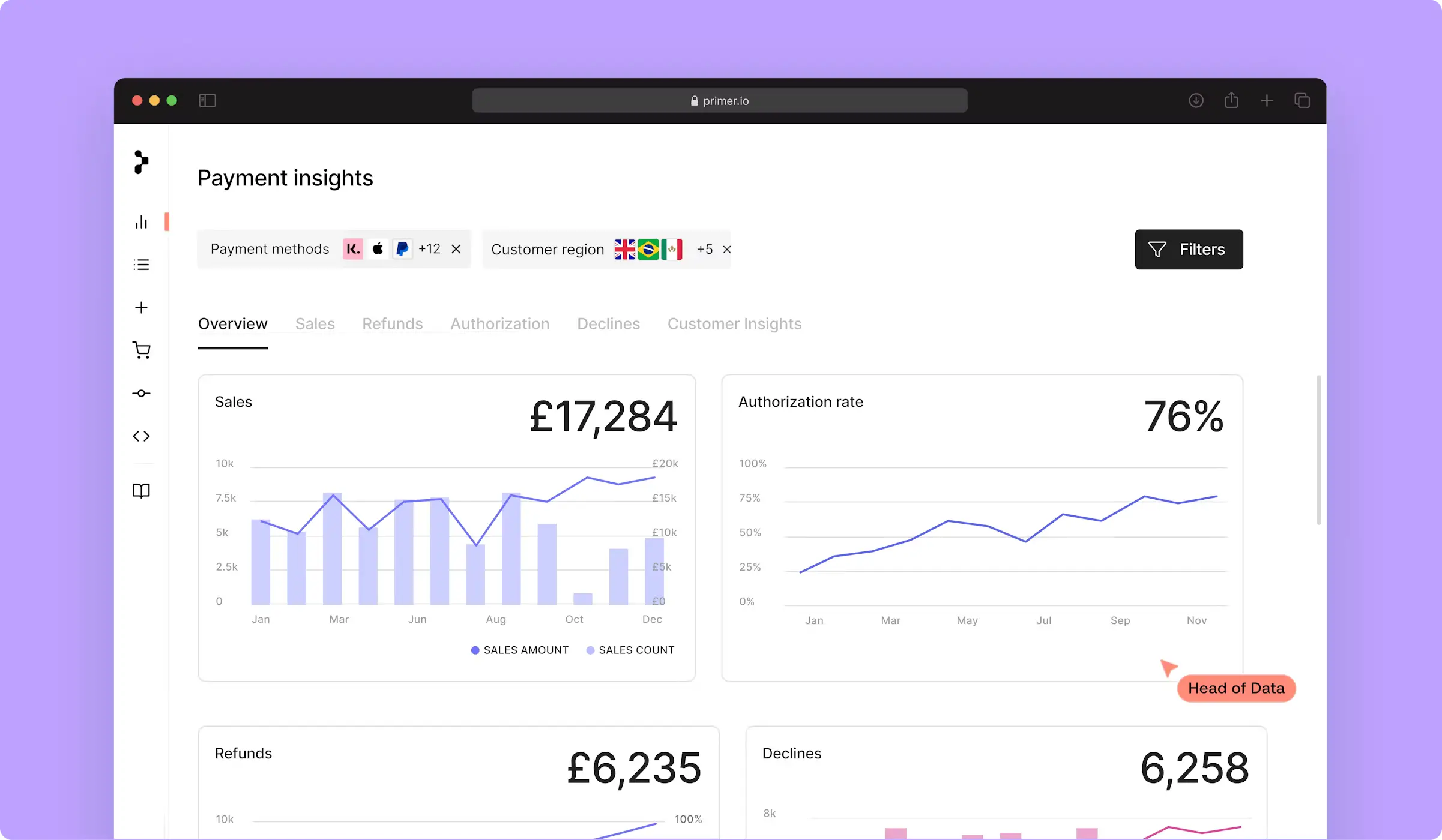

We've developed an observability platform that provides a unified view of your payment data across all processors. With over 40 charts and 35 filters, Primer helps you identify the slightest optimizations for payment success.

Better still, as you use Primer, you can easily apply changes directly in your payment workflows without waiting for developer resources to become available.

Fraud

You may be wondering why fraud's a factor in payment success. But if a payment turns out to be fraudulent, you might need to repay the order amount, so it's best to ensure you're also optimizing this area of the bus well.

Fraud leaves a significant dent on business operations and financial standing. According to the LexisNexis True Cost of Fraud study, every dollar of fraud cost ecommerce and retail companies $3.75 in 2022, up from $3.60 in 2020.

Primer has built easy one-click connections into multiple fraud services. You can now maintain full visibility into your fraud service and maximize its benefits, no matter which processor you use.

#8. Treat customers unequally

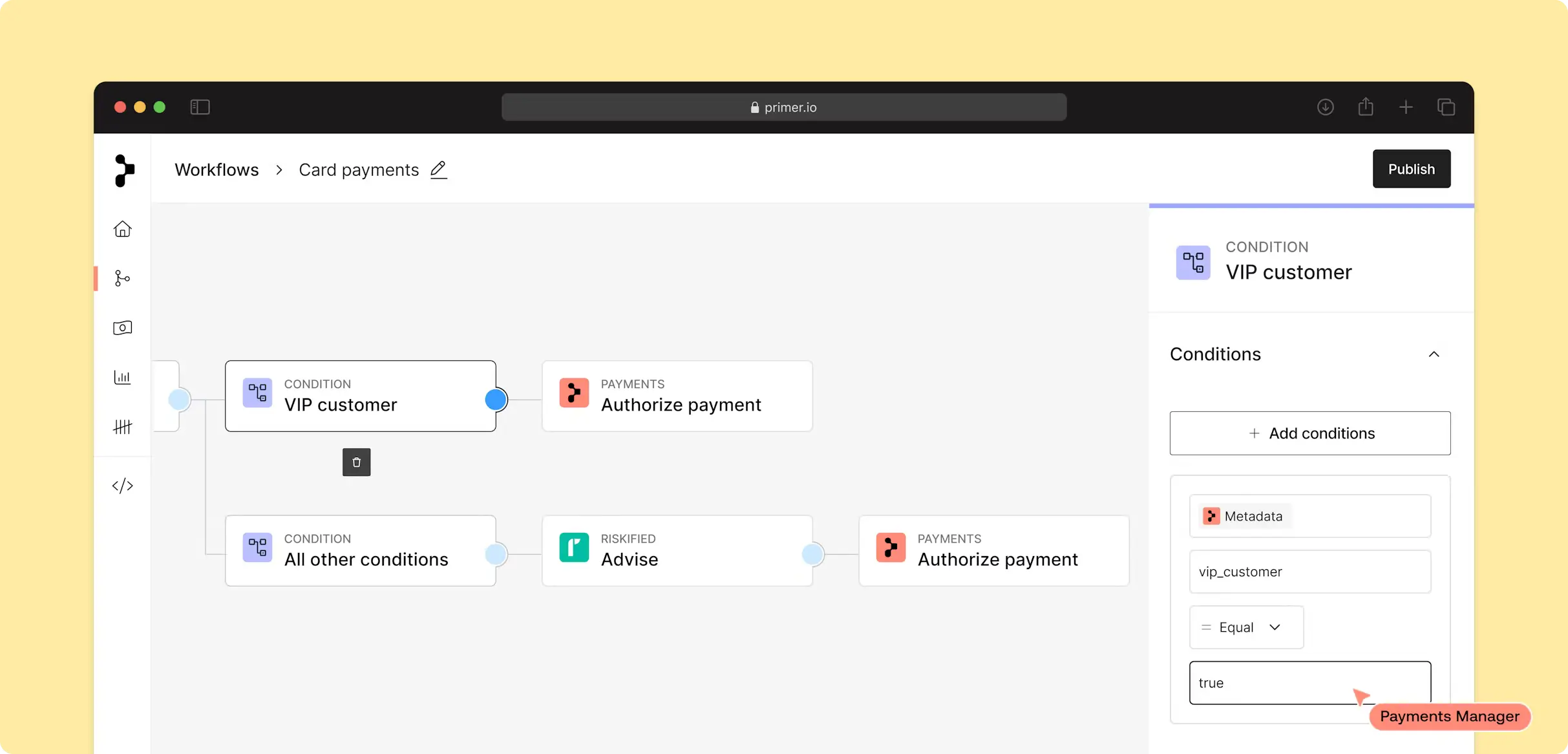

The truth is not all customers are equal. Returning and trusted VIP customers don't need that extra fraud check. On the other hand, you'll want more reassurance for a new shopper who's just added ten of your highest-risk items to their basket.

Protect your business and fight fraud by connecting to one of the many fraud services Primer supports, but don't let this lead to increased instances of false positives.

Study and know your customer base. Then, create separate workflow routes based on their risk profiles to add protection where needed without restricting your trusted customers unnecessarily.

#9. Double up on protection

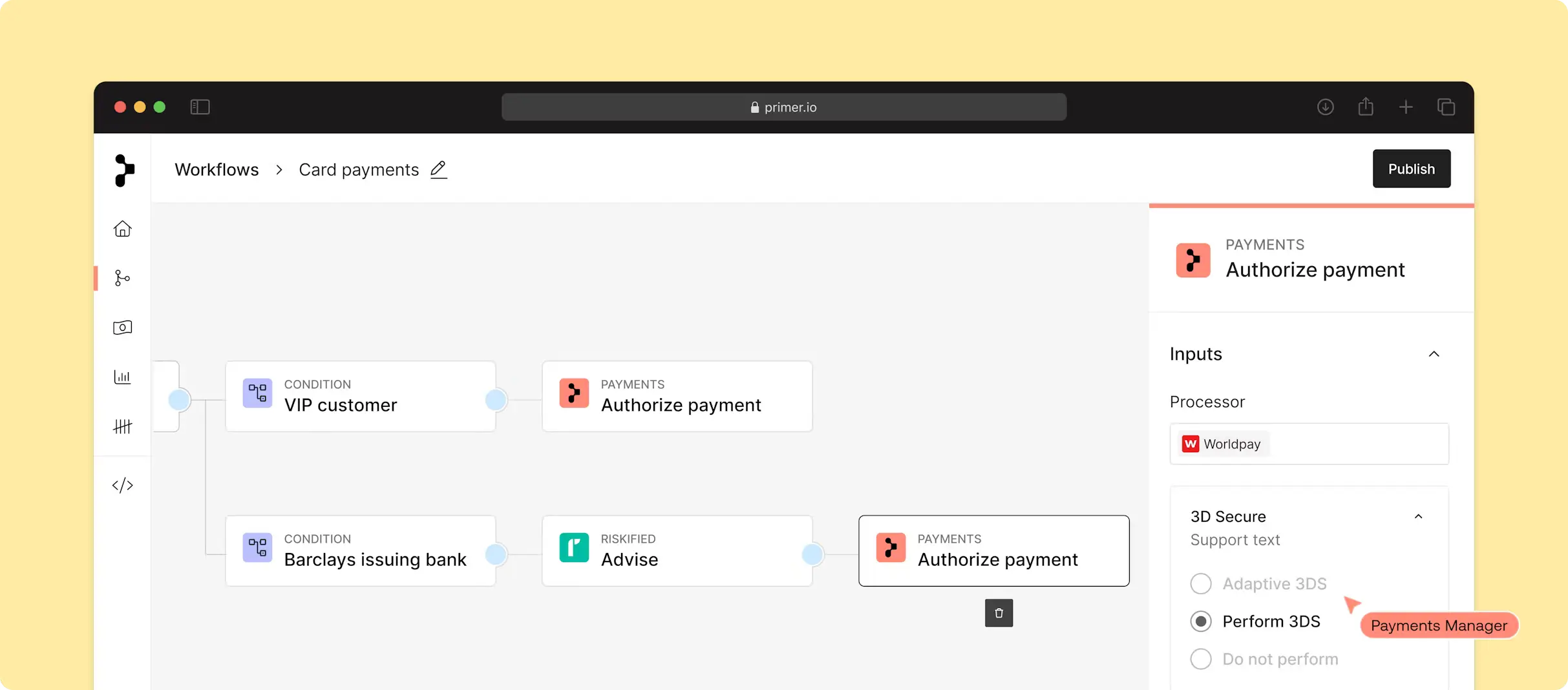

We've talked about the benefits of using 3DS only where required to improve conversion. The same is true for fraud protection. Based on the risk score returned by your fraud provider, protect yourself with some additional security by sending the customer through a 3DS authentication flow.

Usually, this would mean integrating a third-party fraud solution, building conditional logic based on the response, and pausing your checkout flow. At the same time, the test takes place, and resuming the flow with a new 3DS window for riskier customers. Sounds complicated? Now rinse and repeat for every single sales channel!

With Primer, all you need to do is add this logic into your workflow, and Universal Checkout will handle the rest. Again, zero code is required.

Here's how Kilo Health used this exact method to optimize risk and lower costs.

Unlock payment success and capture more revenue today

Your payment flow is one of the most complicated and crucial parts of your business. Primer's no-code payment automation platform will ensure you have all the tools to boost your business' payment success.

Flip the script—do payments right.

Interested in getting more tips on revenue optimization? Get in touch with our team of experts.

.png)